The Buy-Sell Agreement for Partnerships

For background, let’s talk about the purpose and structure of a typical buy-sell agreement. When there are partners in a business, a good business planning attorney would create a buy-sell agreement at the beginning of the partnership. There are many reasons to work with a qualified business planning lawyer, but succession plans are up at the top of the list.

If one partner were to pass away, the others would not necessarily want the deceased’s estate or beneficiaries to own part of the business, or for them to have the legal right to contribute to business decisions. The buy-sell agreement states that in the event of a partner’s death, the business will buy out the partner who passed away. In this scenario, the question then becomes, ‘Does this business have the liquidity to pay off the deceased partner’s family?’ and typically, the answer is ‘No.’

One solution is to pay the family over time. A promissory note is often created, buying out the family slowly over the course of many years, which is not ideal for the business or the family. To work around this, many businesses take out a life insurance policy on each partner. The business is the owner and beneficiary of the policy, and the cash from that policy will allow the business to buy out the family immediately.

US Supreme Court Decision

In a July 2024 decision, the Court of Last Resort ruled that in the case of Connelly v.IRS, the money from the insurance policy must be counted as an asset in the valuation of the business. This could have huge tax implications for many small businesses and may change the way that all business succession plans are going to be structured in the future.

Good Business Planning Practices

The key takeaway from this Supreme Court decision is that good business succession planning practices will be changing. If you are a small business owner of a closely held corporation or partnership, now is the time to contact your trusted legal advisor and make sure your succession planning is up to date with the current state of your business and the current interpretation of tax law. As life goes on, things change and so does our legal business planning.

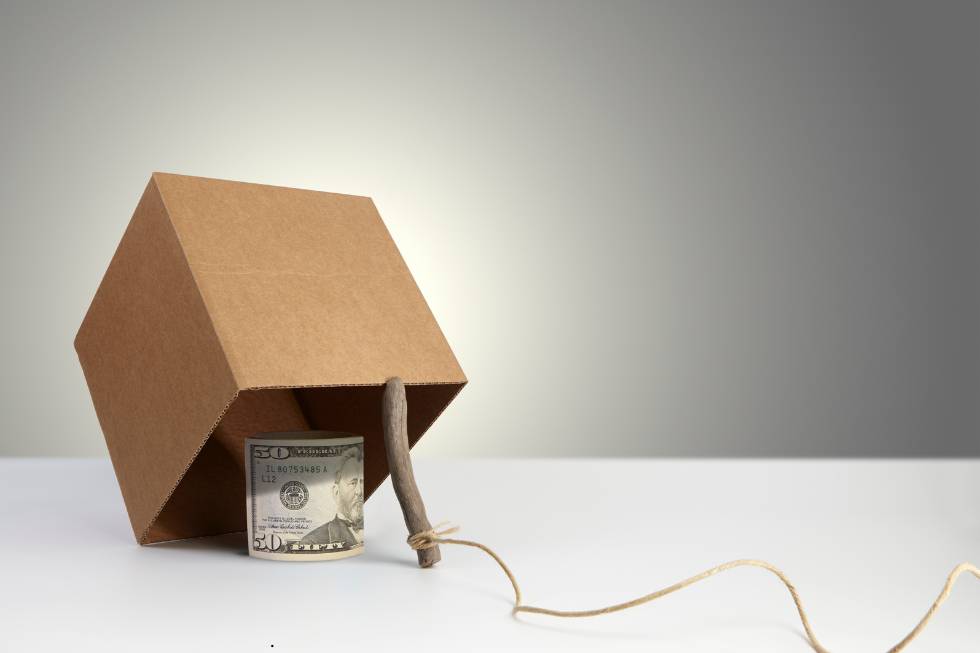

For examples and interesting details, click here to listen to our full podcast about the Connelly case and the buy-sell tax trap.